Silvano Fashion: Negligée Russia risk

Silvano Fashion (TAL: SFG1T, €0.82) is an Estonian lingerie designer and retailer. They are vertically integrated, owning their products from design and manufacturing (about two-thirds of revenue) and all the way to retailing, mostly via franchises.

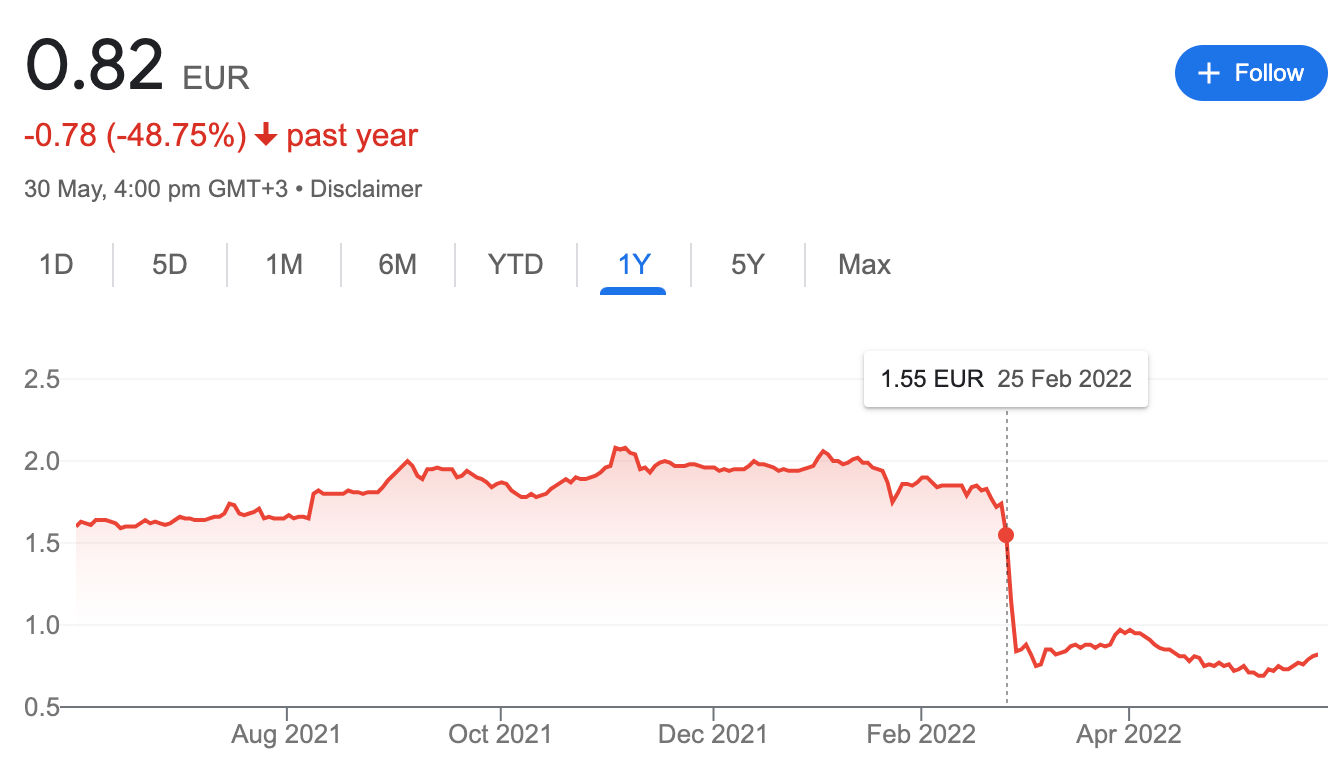

I’ve owned the stock for a little more than 12 months and, with the share price down about 50% since I first bought it, I’m more interested than ever.

If the date of the share price decline doesn’t give away the reason, the table below surely will:

Silvano is much cheaper post Russia's invasion of Ukraine but my view is that the business is unlikely to be impacted materially, if at all, by the invasion over the long term or even short term. Management have already confirmed that they expect the impacts to be negligible even if Ukrainian operations go to zero. Sanctions are possible but it’s difficult to see how preventing the import of lingerie would really impact Russia’s war efforts.

It makes sense to separate the fate of shareholders from that of the business in light of potential expropriations. I consider this a very low probability given it hasn't happened yet and the impacts would largely fall on foreign investors rather than locals who could easily requisition the assets and keep them in use.

More importantly than what could happen is what the current valuation implies must happen for the price to be appropriate. Let’s review the basic operational and valuation metrics:

- Share price €0.82

- Market cap €29m

- Average annual earnings of roughly €10m

- NPAT margins of 15-20%

- ROE of over 30%

- Average annual dividends and buybacks of ~€11.5m over the 8 years to 2019, since halted

- No debt and around €10m of excess cash

Silvano is certainly a high quality business based on its margins and unlevered returns on capital. Trading at 3x average earnings, unless earnings are about to be permanently impaired by at least 50%, or unless there’s a very substantial risk of expropriation, this is far too cheap.

I’m largely discounting expropriation risk so I’ll focus on profitability throughout previous crises, and using Russia and the rouble as a proxy for the entire business.

Crises and currency depreciation are not new for Silvano. Operating profits have consistently either ignored or bounced back from previous crises which include the GFC, the annexation of Crimea, and Covid, with all their associated currency depreciations. The period below even includes the hyper-inflationary period in 2011 in Belarus where the majority of its manufacturing is located.

It’s worth calling out that the chart above includes losses (and occasional gains) from currency transactions, which are the losses or gains associated with bringing volatile foreign earnings home. If Silvano has a receivable for 1,000 roubles (₽) which were worth €12 in January, by March those roubles may only be worth only €10. If they didn’t receive and convert those roubles to euros in time, they’ve lost real money.

This is what’s happened several times due to the ongoing depreciation of the rouble which you can see in the chart below. It knocked an average of €5m from profits in each of 2020, 2016 and 2009. Absent those FX adjustments though, Silvano’s profits have been remarkably stable throughout major crises over the past decade. Silvano has just earned more roubles to send home the same number of euros.

The GFC was the major exception where a severe recession led to inventory liquidations and price cutting across the industry. However, you can see the associated bounce back in 2011, driven by from channel fill and increased margins resulting from shortages. This drove operational profits to all time highs and currency adjustments actually added €17m to profits on top.

There are already early signs that Silvano is once again navigating the current crisis without much trouble. The Q1’22 operating results are in line with Q1’21 despite including one month of results after the commencement of the war, and a ~€3m currency loss is about to be reversed and to turn into a tailwind from Q2.

So how is Silvano so robust in the face of these challenges and why should we expect this to continue? Silvano certainly have pricing power resulting from their brands. The language barrier makes researching the brands difficult, but at least one bloke on the internet believes that Milavitsa, their key brand, has the highest market share in Russia.

Recessions and high inflation may temporarily lessen the availability of discretionary income to buy luxury items, but it doesn’t remove the desire to do so. I profess no insight into the psychology of lingerie buyers, but I would suspect that indulging in something expensive is part of the appeal. Cheap lingerie would seem to miss the point.

Lastly, the Russian economy will continue to chug along and people will continue to want lingerie. No matter what geopolitical issues we see over the next decade, there’ll be USD$1-2tn of economic value created in Russia each year, and Russians will continue to allocate a tiny slice of their income to lingerie. No matter how that income is denominated, it always seems to make its way back to Silvano.

Turning to valuation then, given its high quality and ample shareholder distributions, but small size, zero growth and the proven risk of its geographies, I figure an appropriate valuation for Silvano is in the vicinity of a 12-15% cost of equity. On roughly €10m of earnings, that’s a range of €65 - €85m.

Even if you were to assume a couple of currency depreciations a decade you might trim the valuation to €60 - €80m. However that ignores the very real upside which can result from currency fluctuations, and which is playing out currently. I wouldn’t bank on this continuing though, given the current capital controls in Russia will eventually be released.

Lastly, Silvano ticks all the boxes that keep institutions away and which give me greater confidence that high returns are on the table. It’s tiny, unexciting, in an old world industry which doesn’t grow, is in an uninvestable region and regularly faces material and unforecastable hits to earnings.

There are plenty of reasons to require high returns from this business, and 12-15% is my view of what's high enough. Today’s buyers stand a very good chance of earning much more than that.

My base case is for dividend yields north of 20% with some catchup special dividends on top, meaning the entire market cap will be paid out in distributions in just a couple of years. Downside appears pretty limited as well. I struggle to come up with a scenario which leaves the operating business worth less than €20m after netting out the excess cash.

I think it’s a great buy at the current price and hold about a 5% position.